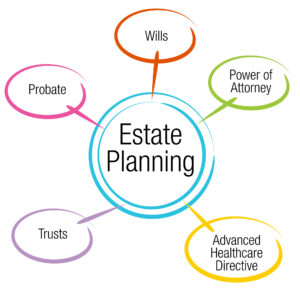

Below are the core documents of an estate plan. You may need all or some of these documents, depending on your assets and life situation.

- Living Trust: A trust is generally the most useful and important document in an estate plan. It is designed to accomplish several estate planning objections, including:

- To maintain or transfer ownership of your trust estate to those you designate upon your death;

- To avoid Probate Court proceedings (up to two years in California) and the resulting fees associated therewith;

- To reduce the risk of family dissension and possibly court litigation; and

- To protect your privacy and the privacy of your estate plan.

Your trust provides that during your lifetime you will fulfill all the roles in your trust: being a settlor (your assets are in the trust), the trustee (you are in charge of your assets), and beneficiary of your trust (you use your assets as you wish). Upon the death of all settlors, your successor trustee will be able to distribute your trust estate to the successor beneficiaries set forth in your trust.

Pour Over Will: This document is mostly a back-up for your trust because you should have your assets in the trust, which will dictate the distribution of your estate. Should your assets be all or mostly transferred to your trust, your will primarily serves to “pour over” into your trust any assets or possessions that were not transferred should they be worth less than the probate limit. In Oregon, you also nominate guardians in your will.

Pour Over Will: This document is mostly a back-up for your trust because you should have your assets in the trust, which will dictate the distribution of your estate. Should your assets be all or mostly transferred to your trust, your will primarily serves to “pour over” into your trust any assets or possessions that were not transferred should they be worth less than the probate limit. In Oregon, you also nominate guardians in your will.- Nomination of Guardians: If you reside in California and have minor children, this document is imperative because if you do not make a guardianship nomination, a court will do it for you. This means your children may be in State custody while the decision is being made, and they could end up with a person(s) who you would not approve of.

- Durable Power of Attorney for Finance: It is a powerful tool that allows your agent to sign documents for you and speak with people on your behalf for most matters (except medical decisions and trust related matters). It generally does not impact the functionality of the other documents in your estate plan, and you are not required to sign or use it. Under certain circumstances, however, such as your incapacity, it could be very useful to enable your agent to successfully manage your affairs and estate during your lifetime. It loses all legal effect upon your death.

It allows your agent to obtain or maintain benefits from outside sources such as governmental programs, insurance companies, and financial institutions. It could be used to put an asset in your trust before and after your incapacity.

- Advance Health Care Directive: This document is a power of attorney for health care, which provides your named agent with the power and tools to make independent medical and practical decisions on your behalf if you are unable to do so. It advises your agent and physicians of your intent regarding major issues such as burial, cremation, organ donation, and end-of-life decisions. It does not directly affect the other documents in your estate plan, and you are not required to sign or use it.